refinance closing costs transfer taxes

Mortgage closing costs typically range between 2 and 6 of your loan amount. Ad Quicken Loans Americas Home Loan Experts.

Closing Costs Why They Matter And What You Will Pay

When youre determining what to claim on.

. You closing costs are not tax deductible if they are fees. You can only deduct closing costs for a mortgage refinance if the costs are considered mortgage interest or real estate taxes. State Recordation or Stamp Tax see chart below County Transfer Tax see chart below Borrower pays on the difference of.

But they can run between 2 and 6 of the total amount borrowed. Since this is a refinance there are no closing costs associated with acquisition of the property. That means youd likely pay.

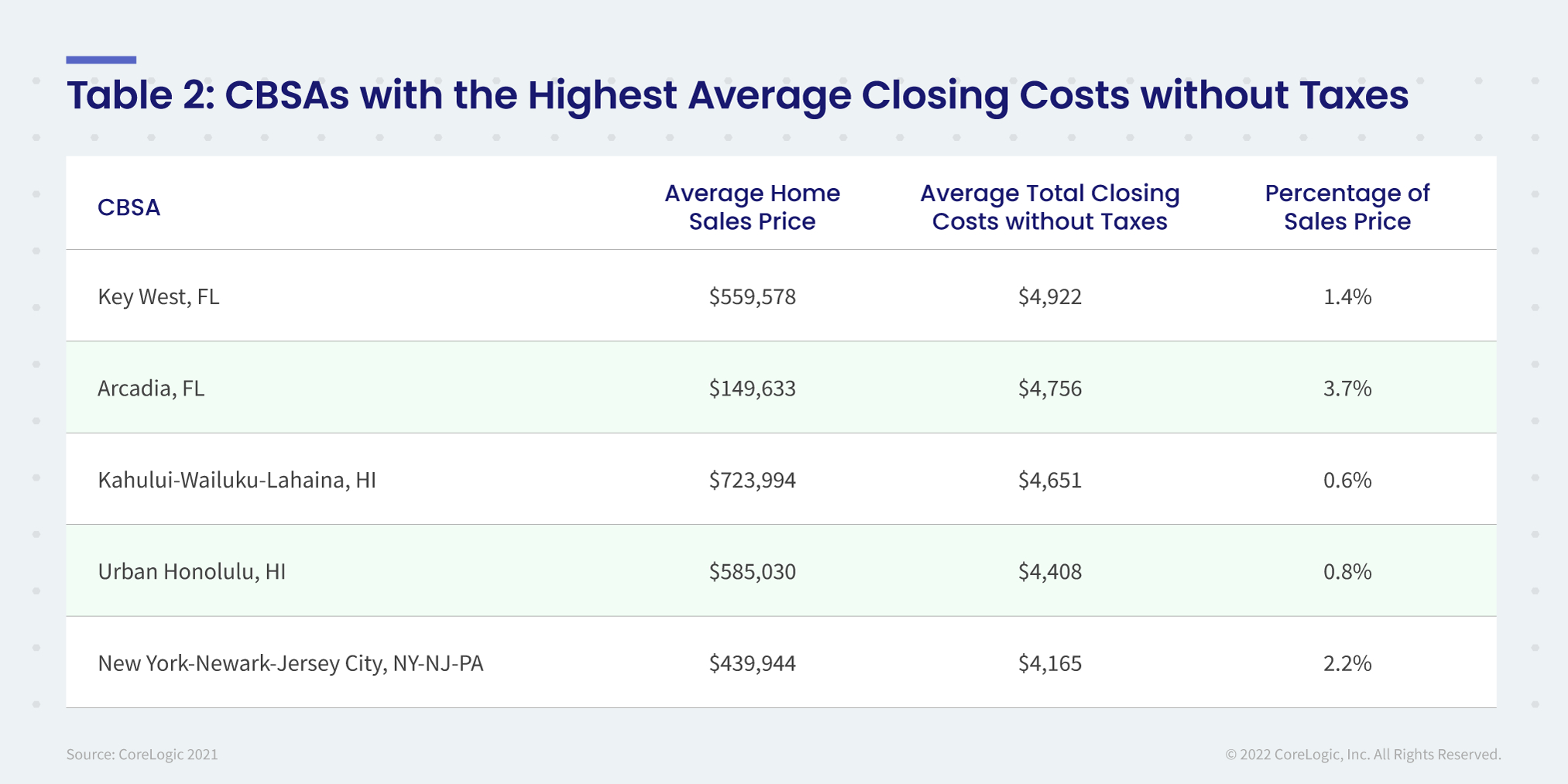

Although there are some recognized loopholesways to get a tax-deductible status on various costs of closing on your housethere are still many costs that are strictly. Does not apply to refis just purchased in PA. The national average closing costs for a single-family property refinance in 2021 excluding any type of recordation or other specialty tax was 2375.

Transfer Tax -1 5 County 5 State Property Tax 0883 per hundred assessed value 1012 County 132 State MONTGOMERY COUNTY 240-777-8950 Recordation Tax 690. You cant deduct more than 10000 per year 5000 if married filing separately in property taxes sales taxes and state and local income taxescombined. 2400 12 680 034 None.

Because rates are now above pre. Paying property taxes and other costs when refinancing. For instance lets assume that you refinance your mortgage for 200000 and you had 5000 to close the deal.

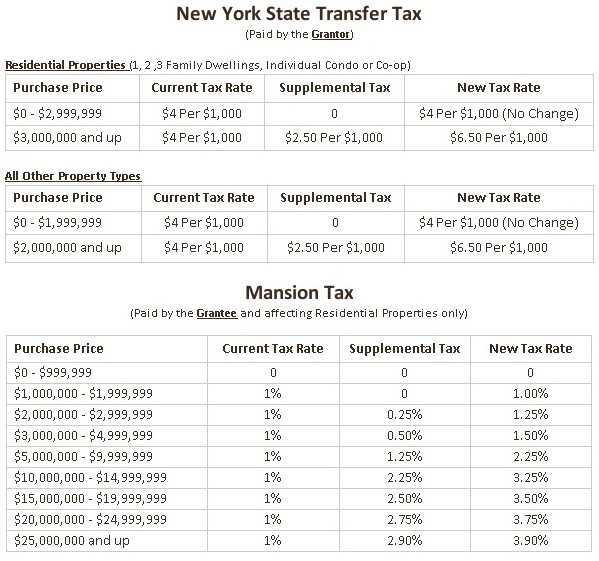

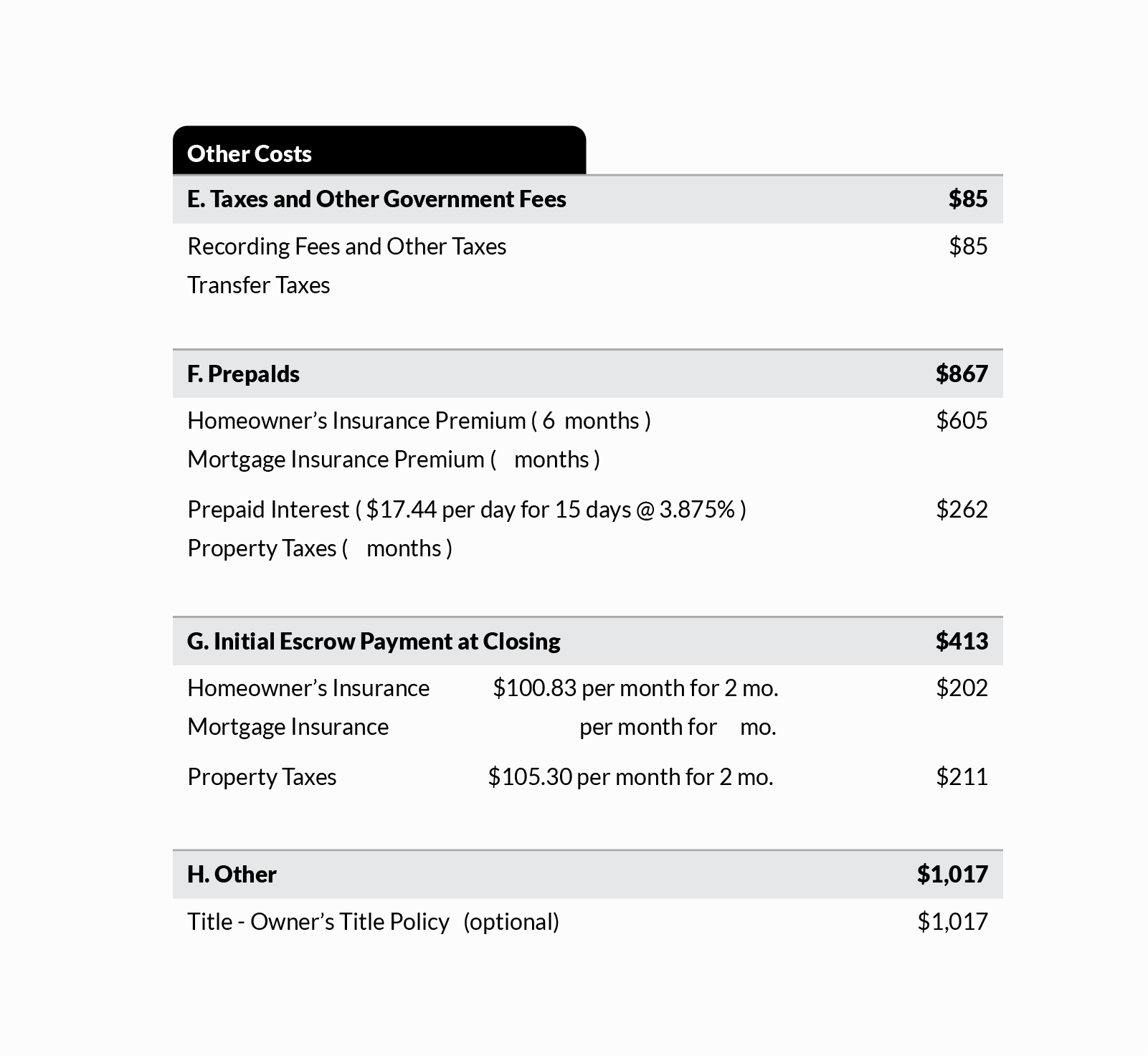

Transfer tax is assessed as a percentage of either the sale price or the fair market value of the property thats changing hands. State Transfer Tax is 05 of transaction amount for all counties. The only settlement or closing costs you can deduct are home mortgage interest and certain real estate taxes.

While that was is up 88. As you prepare to set aside money for your refinance closing. So theres nothing from those costs to add to the cost basis.

In April of this year the average 30-year fixed rate hit 5 for the first time in 11 years and its increased nearly every week since then. Other closing costs are not. Many states charge a feetax when a home is.

Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You. State laws usually describe transfer tax as a set. You have an interest rate of 35 on a 30-year term.

Many other settlement fees and closing costs for buying the property become additions to your basis in the property and part of your depreciation deduction including. Total transfer tax. Not a single penny.

For example in Michigan. Your monthly mortgage payment would increase by 2250 per month. You can write off some closing costs at tax time.

If you are using 100000 of your loan money to do renovations. No closing costs including the below are not tax deductible but may increase the cost basis of your home which may benefit you in the event of sale. In a refinance transaction where property is not transferred between two parties no deed transfer taxes are due.

Average refinancing closing costs are 5000 according to Freddie Mac. National average closing costs for a single. Your lender does not know what they are doing.

You deduct them in the year you buy your home if you itemize your deductions. Typically the only closing costs that are tax deductible are payments toward mortgage interest buying points or property taxes. Ad Quicken Loans Americas Home Loan Experts.

For example a homeowner who paid 2000 in points on a 30-year mortgage 360 monthly payments could deduct 556 per payment or a total of 6672 for 12 payments. Youll typically pay mortgage refinance closing costs equal to between 2 and 6 of your loan amount depending on the loan size. When the same owner s retain the property and simply.

Our Trusted Reviews Help You Make A More Informed Refi Decision. If you roll the closing costs into your loan balance. Note that transfer tax rates are often described in terms of the amount of tax charged per 500.

Call us for a quote 2675144630 x1.

Real Property Transfer Tax Increase The Judicial Title Insurance Agency Llc

What Are Real Estate Transfer Taxes Forbes Advisor

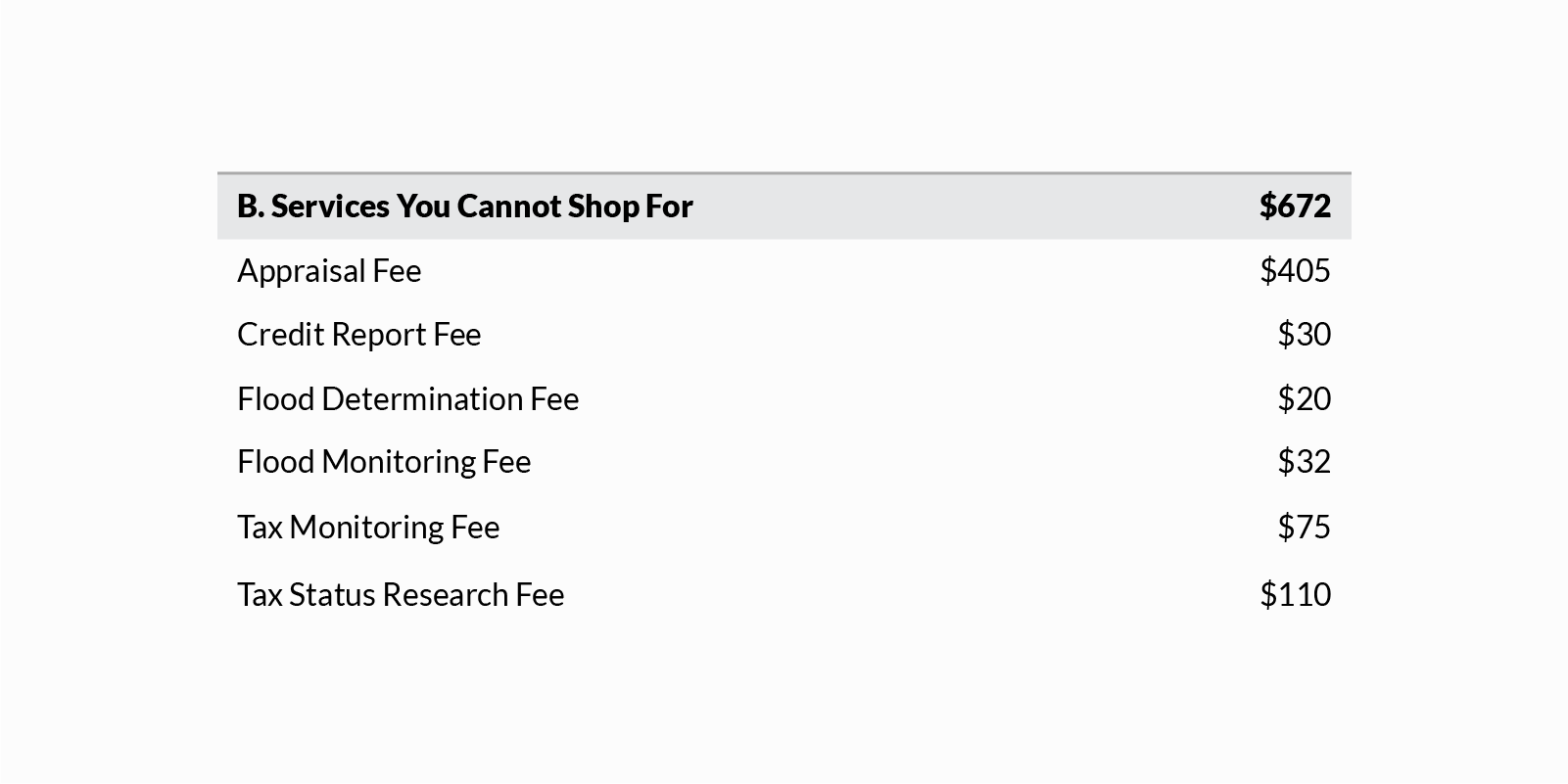

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Reducing Refinancing Expenses The New York Times

What Goes Into Closing Costs Mortgage Loan Credit Refinance Loans Financing Banking Reales Real Estate Infographic Real Estate Tips Real Estate

Mortgage Tax In Nyc Nestapple Biggest Commission Rebate

Nyc Mortgage Recording Tax Of 1 8 To 1 925 2022 Hauseit

No Closing Cost Mortgage Is It Actually Worth It Credible

What Is A Loan Estimate How To Read And What To Look For

Understanding Mortgage Closing Costs Lendingtree

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Understanding Mortgage Closing Costs Lendingtree

Nyc Nys Seller Transfer Tax Of 1 4 To 2 075 Hauseit

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

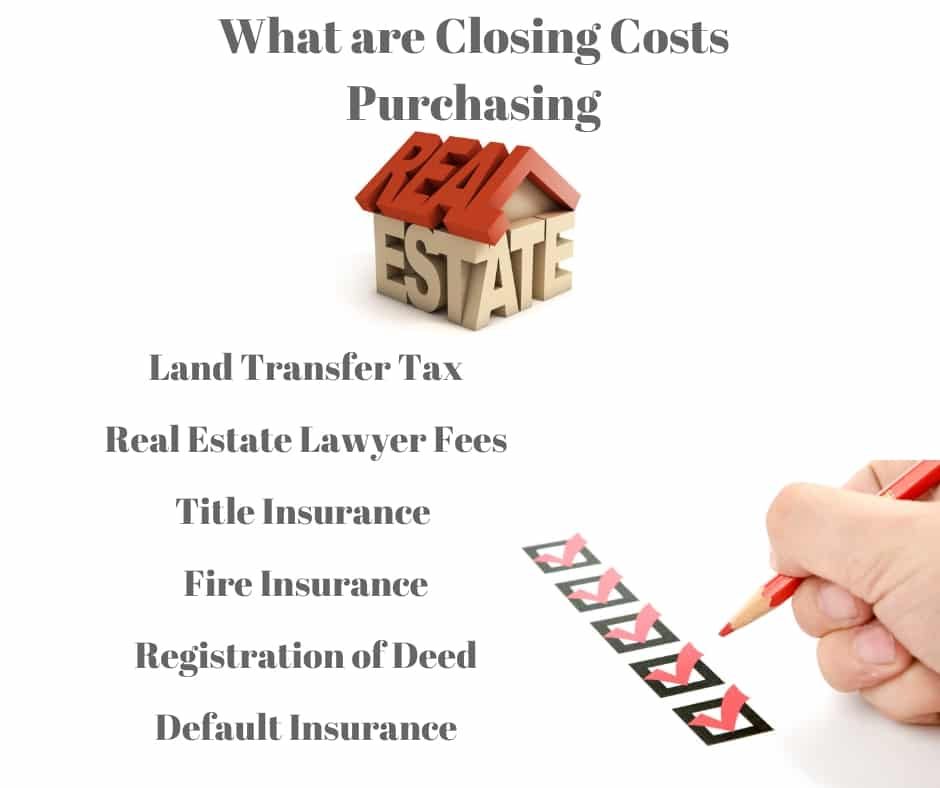

Closing Costs Ontario You Must Know Before Buying Or Selling Property